DISCLAIMER: READER SUBMISSION, DO BE KIND.

If you’ve read this far, please consider subscribing to our email newsletter (yes, this Substack). We cannot offer you much but we can offer this:

We have newsletter-exclusive articles that won’t be posted anywhere else. We created these articles for people who want to go deeper into complex issues than the shorter-form content we typically have.

If you don’t have social media or don’t follow our Telegram channel, you can still get updates to all our content emailed directly to your inbox to read at your own time.

We promise not to spam your inbox (but Substack might, so update your notification settings).

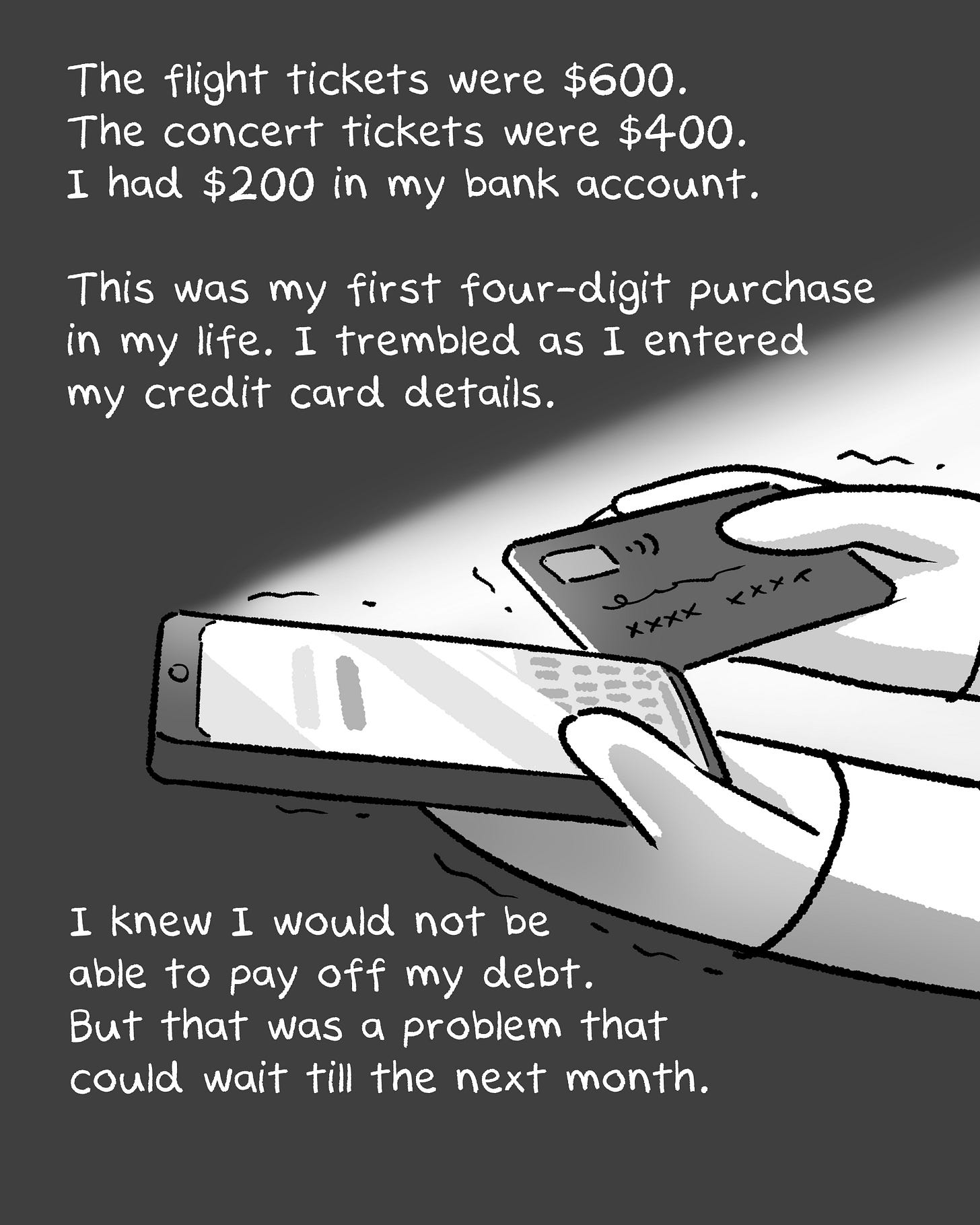

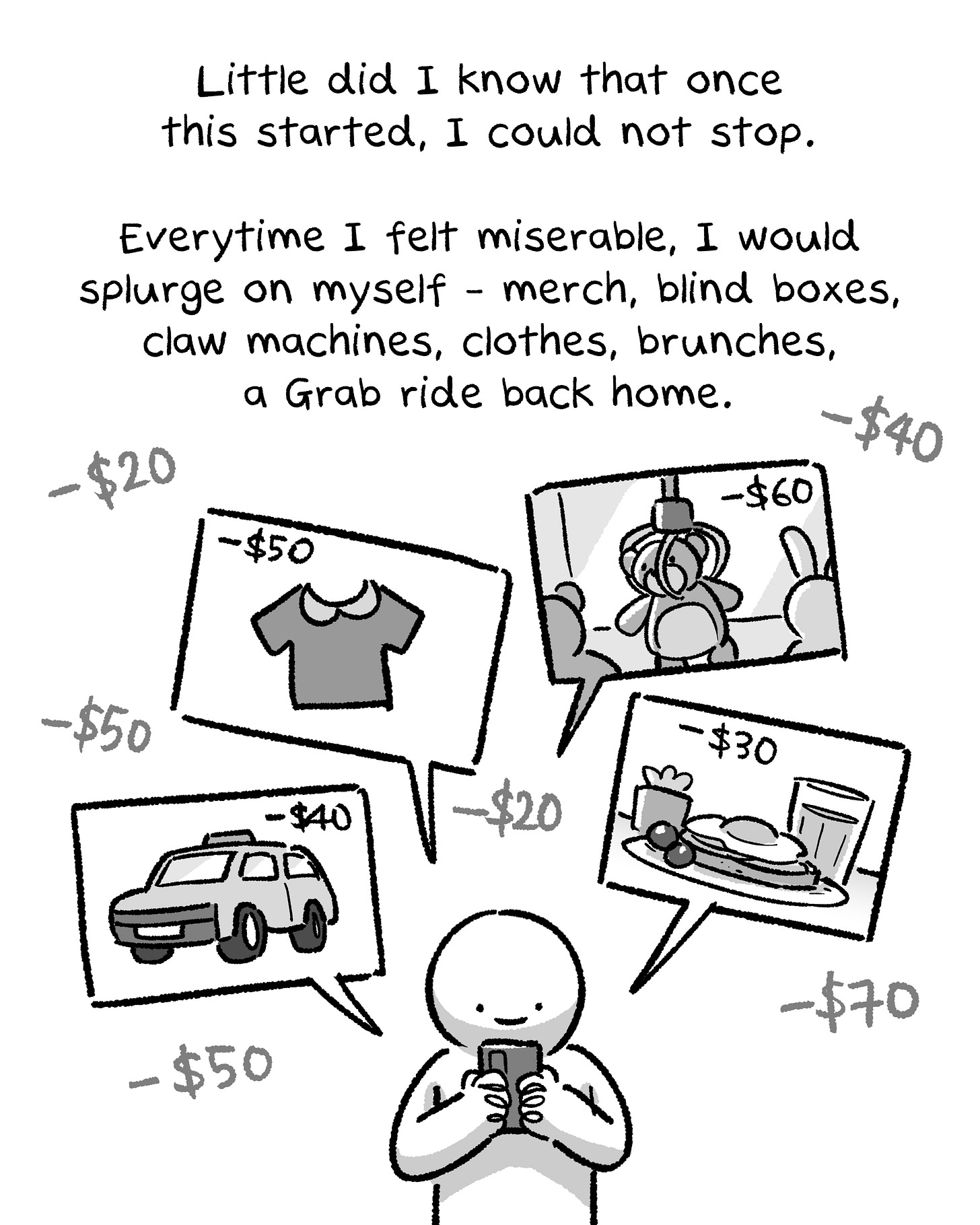

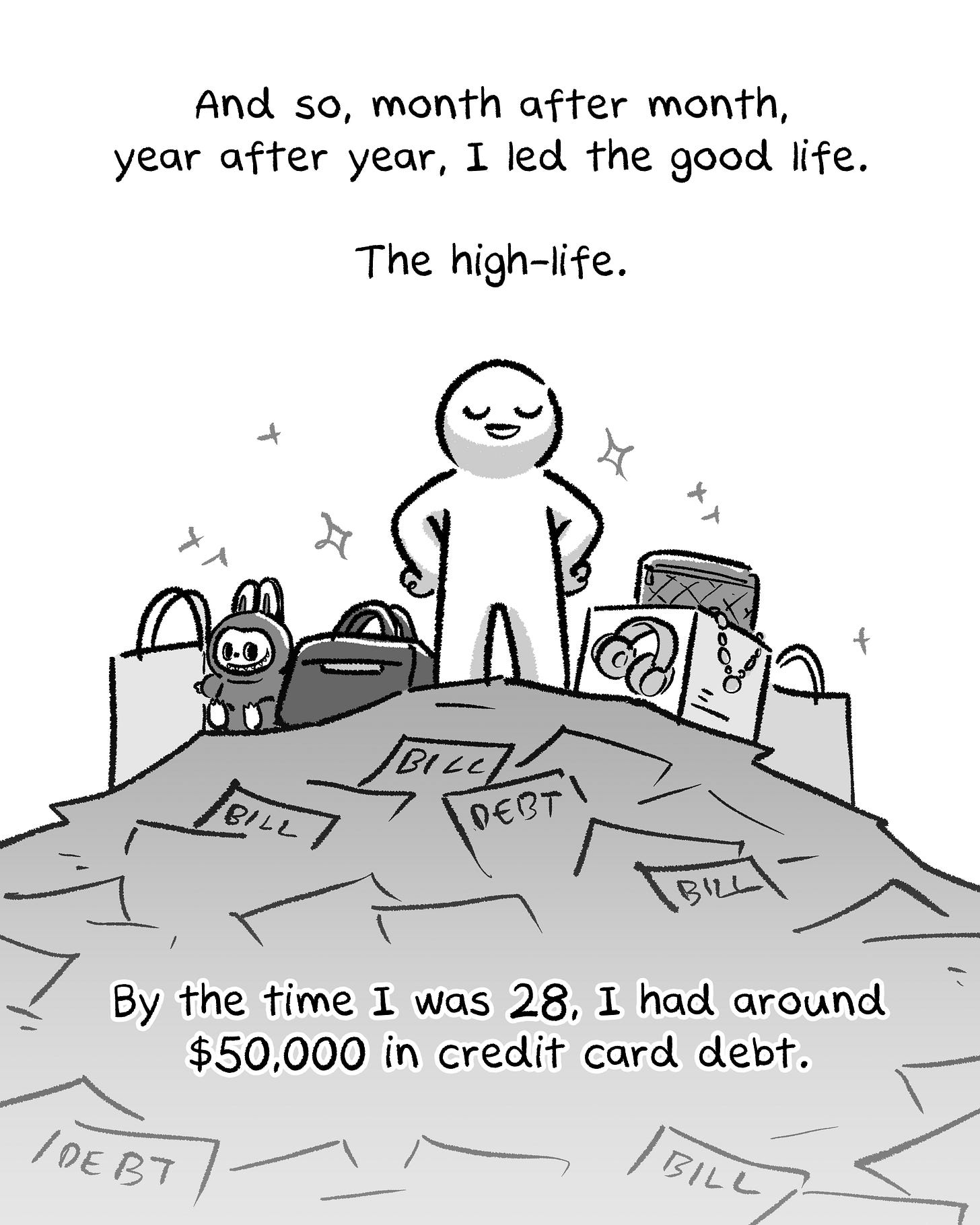

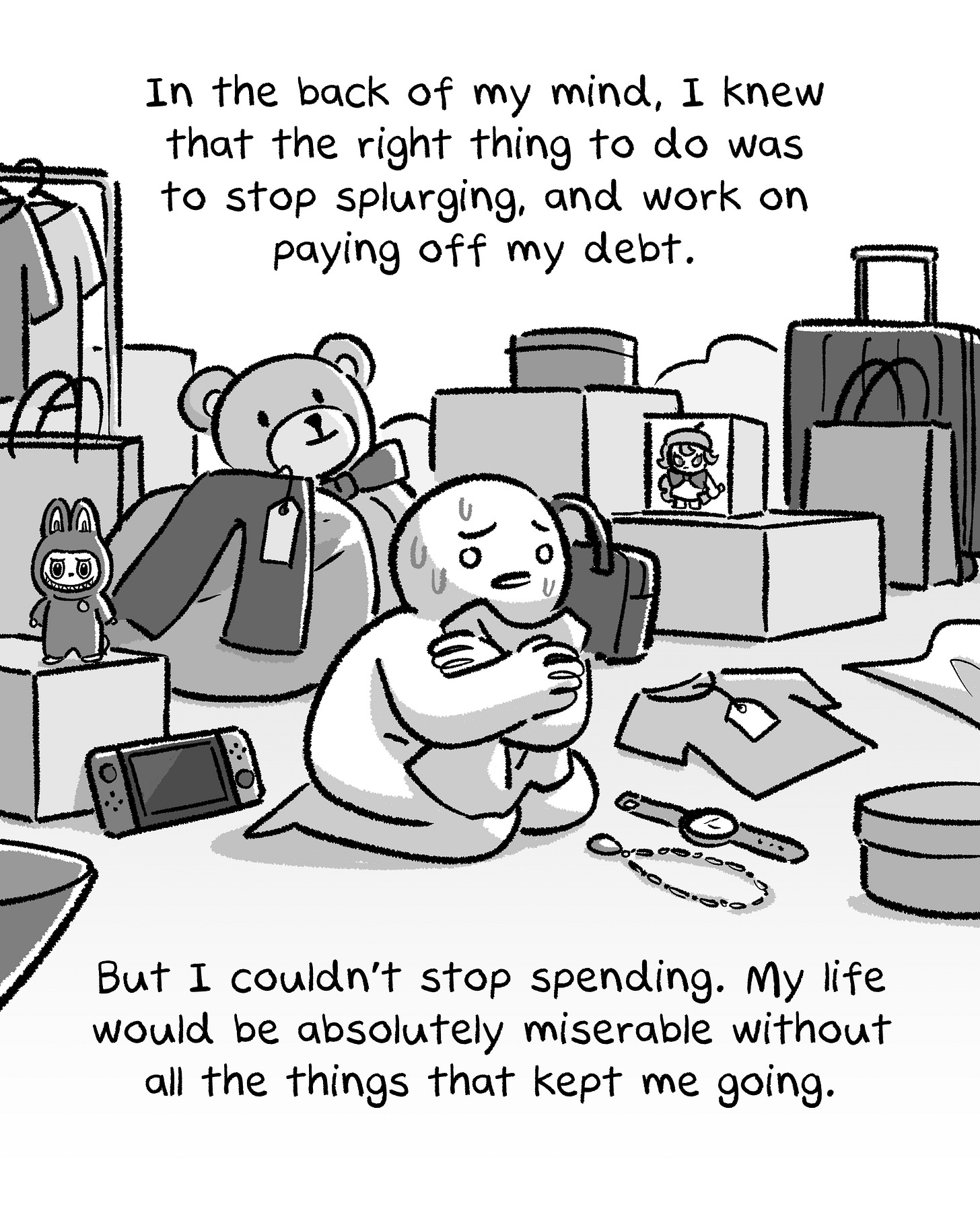

This resonated deeply for me as well; whether it was lack of knowledge or inability to regulate that led to bad spending habits, I was in that situation. I still am, but I'm no longer mentally bogged down by the uncontrollables, and would like to offer my story.

1. I cancelled all my cards. My credit ratings was gonna take a long while to recover but there was no benefits in keeping the interesting running.

2. My support system was not strong so I turned to credit counselling. You could try debt repayment scheme but a different type of consequence (declaring bankruptcy is one of them). CC helped to put my mind at ease. They helped to liaise between the banks and even did a budget for me to gauge how much I should set aside. I was no longer hounded by this large sum.

3. I stopped ALL spending - no excuses. My lifestyle changed, my friend circle changed. That in turn changed my values in life too.

4. I'm still paying off debt, but it's not eating into my conscious. I say no to a lot of things. I clear the smaller sum first, while still having enough to go by. Did up monthly excel sheet and realised that I need higher salary or extra side hustle. So that's the motivation to focus on yourself at this point.

It'll be doubting but deciding to do something now is better than dragging it on. Trust in your ability to pick yourself up.

Hi there Broke Salaryman,

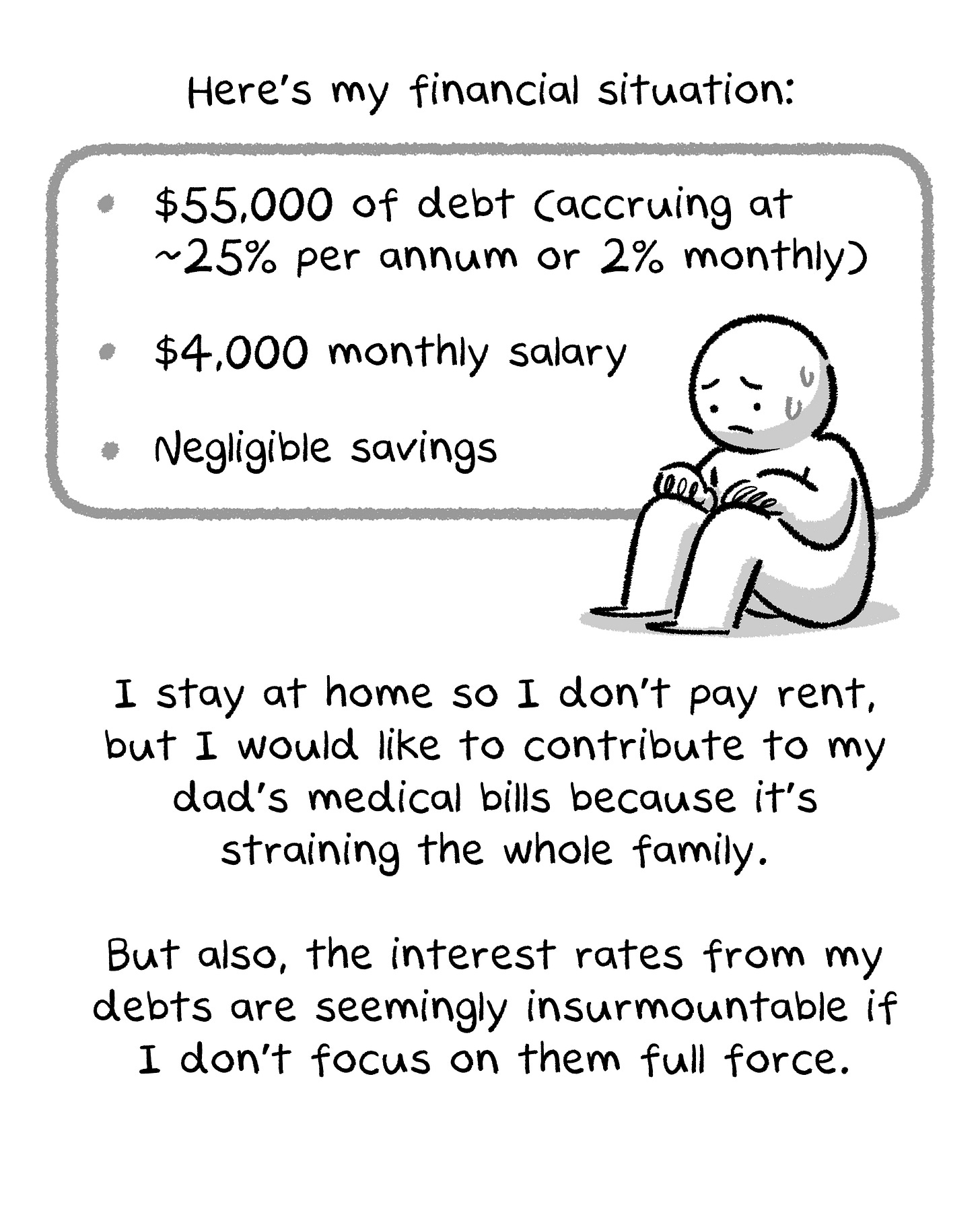

I agree with TWS on the point that you should tell someone (your family) about your debt, simply because for now focusing on paying all of your debt is better than chipping in for your dad's medical bills.

I know it sounds cruel, but the interest of your debt is 1,100 per month if nothing's being done about it. That's debilitating, and unfortunately you really can't afford to help out your dad right now and must rely on others to do it.

Take it as a hard life lesson for being careless about your finances.

Now, I suggest you work on the debt one by one. Since you have a lot of debt spread out in different credit cards, work towards paying off the ones with the smallest amount due.

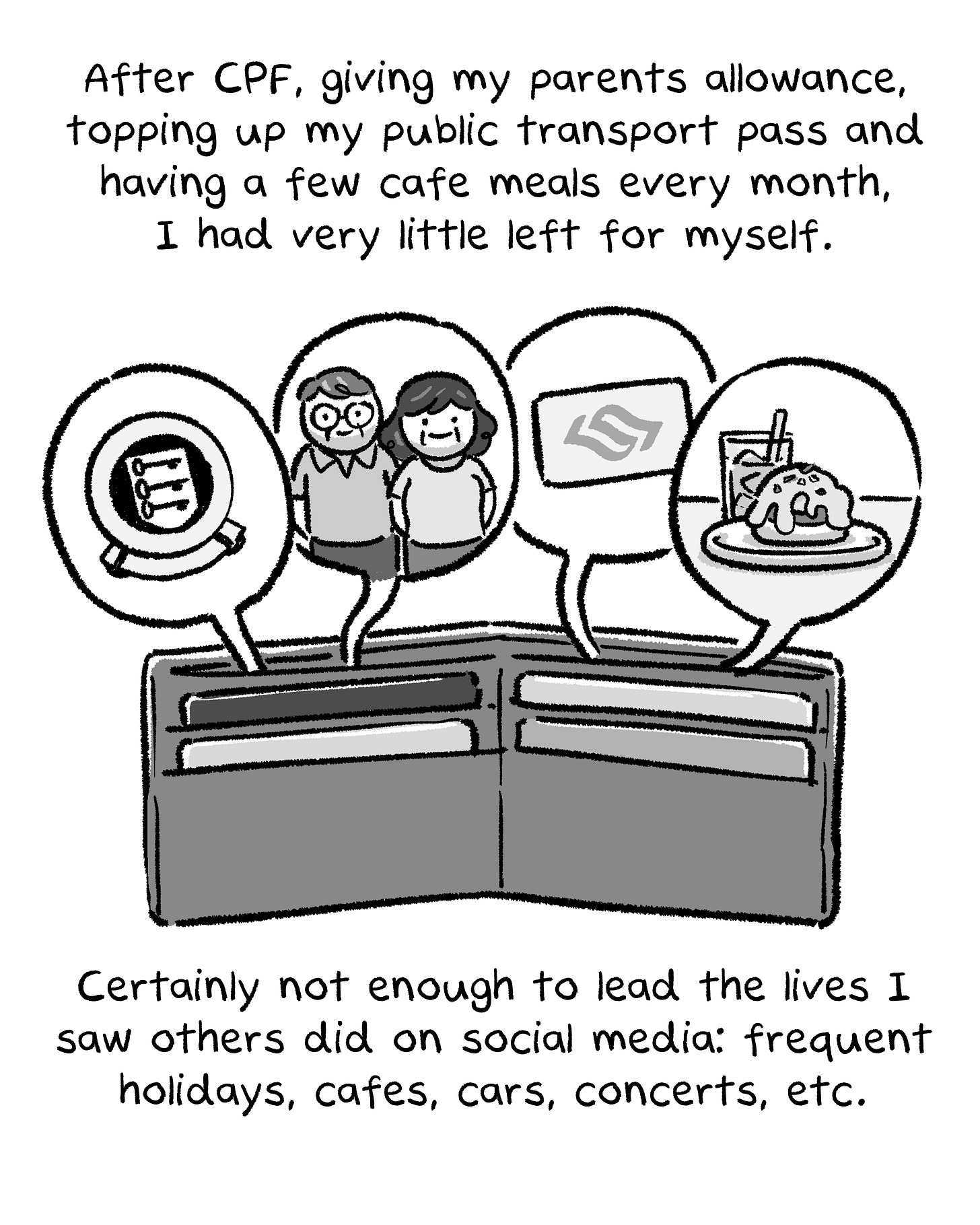

Be prepared to significantly cut down on your spending and live extremely frugally. Perhaps allocate 1,500 every month from your salary for your debt. So your remaining will be = 4,000 - 800 (CPF) - 1,500 (debt payments) = 1,700 monthly for living costs. Sounds tight but doable, you just need to not spend on much/any luxury items at all.

Look up budget meal options and free hangout places to help you ease into the frugal lifestyle.

Also try to consolidate your debt! 2% monthly is too high and from the amount you pay back, only half actually goes to paying off the principal, the rest is paying the interest.

Last but not least, good luck! You are not alone. Many people were in your spot and they made it out. It's tough, but doable.

After debt consolidation, try to take side gigs/freelancing if you can, just to boost your income to help pay off your debt even faster!