Why buying a car can be a bad decision in your 20s (or even 30s)

How much are you willing to sacrifice for freedom on wheels?

DISCLAIMER: We first published this article on 9 May 2022, where it was previously sponsored. We’ve updated the stats to reflect the current market in 2024. Spoiler alert: It’s even more expensive now.

Typically, we don’t encourage youngish folks who are building their finances to buy a car.

Why?

Cars in Singapore are expensive. They depreciate rapidly. And most people can actually get by without one.

Money spent on a car could have been used for important life goals: retirement, dreams, education, travel, family.

That’s the gist of it.

Admittedly, articles like these always attract an inordinate number of people defending their purchase decisions.

So let us first say: We acknowledge the many pros of getting a car.

For many people, cars are not merely a way to get around. There are many benefits (both tangible and intangible) to owning one:

Carrying of bulky/heavy items: A personal vehicle allows you to carry bulky items that might otherwise be unwieldy to carry around on other transport services. Child seats and wheelchairs are great examples.

For people who can’t use public transport: A car makes transportation of crying young children and frail elderly A LOT less stressful. During the pandemic, many opted to buy cars to reduce COVID-19 exposure for their families.

Convenience: Owning a car allows you to be independent of public transport schedules and ride-hailing — both of which usually operate pretty well in Singapore. However, there are areas that are just not as well-served (think Tuas or Changi) as compared to the others.

Identity and social status: For many people, a car isn’t purely a means of transport. It can evoke feelings of self-worth or pride, or grant entry into a community. There’s also the argument that a car helps you to look like a successful person in front of your clients. I’ll just leave it at that.

Recreation and social interaction: Driving and going for joyrides are legit ways to unwind and meet friends. If you’re still looking for a partner, having a car will make all those late-night supper dates a lot more feasible.

Long-distance travel: When we say long distances, we don’t mean Joo Koon to Pasir Ris. We mean intercity trips: Singapore to KL, Singapore to Malacca, that kinda stuff. (From an environmental and urban planning perspective, cities are not the ideal place for cars. Further reading.)

That said, all these benefits come at a price. If cost wasn’t an issue, most people would want a car.

The question now is:

Can you afford a car, and should you?

Let’s take a look at some considerations.

Do you earn enough?

Even if you have the large lump sum downpayment for your car, it doesn’t mean that you should immediately think of buying it. Why? Because cars need money to operate — think petrol, parking costs. And that’s on top of your monthly instalments and insurance premiums.

Let’s take a look.

New Car

Estimates for the monthly cost of a new entry-level car ranges from anywhere between $2,000 to $3,000 a month.

You can find modest estimates by DollarsandSense ($1,978), SingSaver ($2,630), or Seedly ($2,265) here.

That said, for the purpose of this article, we’ll be using OneMotoring’s estimate of owning a brand new Toyota Corolla Altis. Approximately $2,800 a month. You can check out operating costs for other models here.

If you earn the median gross salary of $5,197 (2023) a month, that would be 67% of your take-home pay after CPF. That leaves you with about $1,400 for your other expenses. Big yikes.

Used Car

You can expect to pay at least between $900 – $1200 a month in car loan for an entry-level used car. However, after factoring in running costs of at least $11,000 a year, you should expect it to look something closer to $1,800 – $2,100.

Assuming the lower end of the estimate, that would be 43% of the median take-home salary.

Now, consider this:

Conventional personal finance guidelines advocate the 50-30-20 rule:

Separating your income into three buckets: 50% on needs, 30% on wants, and 20% on saving/investing.

Unless you’re aggressively cutting costs elsewhere to afford your car, planning and saving for the future might be an issue. You might also have to make lifestyle sacrifices elsewhere as well.

For you to be spending a sensible 20% of your income on your car, you’ll need to earn a take-home income of $10,000 for the brand new car (based on $2,000).

(You can also make a copy of our CARculator Google sheet to figure out if you should buy a car or just ride-hail when needed. Requires Google Login).

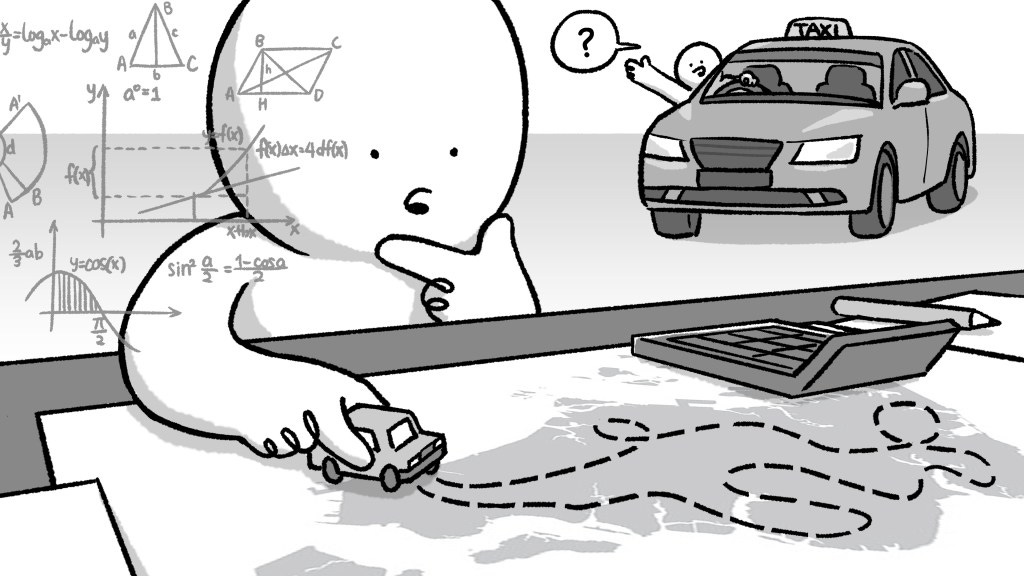

Is ride-hailing cheaper?

No cost-based analysis involving car usage can escape the comparison to ubiquitous ride-hailing services — the closest alternative in terms of cost and convenience.

Generally, the more trips you make per day, the more it makes sense to use a car as opposed to hailing a ride. The following calculations are based on estimates of $15–$25 per trip.

Scenario A: Single Professional

Trips per day:

Home-to-office

Office-to-Home

A single professional who only drives to and fro to the office will spend $600 – $1,000 on ride-hailing over a course of 20-working days. Not a small amount, but not enough to justify even an entry-level car.

Scenario B: The Nuclear family

Trips per day:

Home-to-physio

Physio-to-Home

Home-to-school

School-to-Office1

Office1- toOffice2

Office2-to-Office1

Office1-to-school

School-to-home

Home-to-physio

Physio-to-home (damn, what a long day)

A family who has two working parents, one physio-going elderly and a school-going child might spend $3,000 – $5,000 a month on ride-hailing.

That's a pretty solid case for this family to own a car.

That said, in a post-COVID world where work-from-home has taken off, this might mean people take fewer trips than what’s furnished above.

In addition, just because driving a car is cheaper than hailing a Grab, doesn’t mean you NEED to buy a car — just because something is cheaper doesn’t mean you should buy it.

This brings us to our next argument.

Can you accept the opportunity cost?

If you’re just on the cusp of affording a car, then here’s one thing you need to realise:

The money you have in your 20s and 30s have the most potential to grow via investing. On the flip side, the value of a car falls dramatically within a decade.

If you make good investments, you may opt to use the returns to fund the future purchase of a car.

If you buy a car, you won’t get those sweet investment returns. Instead, much of your earnings in your 20s and 30s will go towards a depreciating asset.

Let’s use the example of two 25-year-olds, Person A and B.

Suppose Person A spends $24,000 a year on a car (purchasing, fuel, road tax, insurance, maintenance); they’d be set back by $240,000 at the end of 10 years.

Person B doesn’t buy a car. They get an Adult Monthly Travel Pass at $128 a month, and ride-hails every weekend, and as a result, only spend $6,736* a year. They invest the other $17,264 they would have spent on a car, at 7% p.a. over 10 years; they’d have $238,527 at the end of 10 years.

Their difference in net worth after 10 years? $478,527. Not a small amount!

Can you afford to have $478,527 less in 10 years? It really depends on what your goals are, and how much they cost.

For some people, owning a car is the goal itself, or the car is instrumental in helping them reach their goal: e.g. send loved ones around in comfort, meeting multiple clients a day to make sales.

In my 20s, my goal was to attain financial freedom early and then focus on doing work that is meaningful, but might not pay a lot.

Cars, therefore, did not align with my goals. (Though they might align with yours).

*Annual public transport cost of $6,736 is calculated by the annual cost of a Adult Monthly Transport Pass ($128 x 12 months = $1,536) + the cost of taking 2 ride-hails every Saturday and Sunday ($25 x 4 rides x 52 weeks = $5,200)

So who is the ideal candidate to drive a car in Singapore?

In summary, they’d look something like this:

Would otherwise take 3–5 ride-hailing trips per day

Takes home above $10,000 every month, or a household (for a couple, each party will have to earn a salary of at least $6,250)

Have carefully considered the upfront cost, recurring cost and opportunity cost of owning a car

Of course, emphasis on the word ‘ideal.’

In reality, if you start to have young children, or have elderly parents who have limited mobility, then you might find yourself considering car ownership/rental.

If you’re not the ideal candidate to own a car, but still find yourself needing one quite frequently, then you might want to:

Buy a used car that has experienced most of its depreciation (typically one that’s older than 5 years)

Rent a car so you can easily let go of it when you no longer need it

If you only need a car occasionally, car-sharing has also become a more common and accessible option, with companies like BlueSG, GetGo, and Tribe Car popping up.

Unlike longer-term rental or ride-hailing, car-sharing usually requires advanced planning to be able to book the car. Not very useful for spontaneous rides.

But it’s a more cost-effective way to have the convenience of a car when needed, without the costs of ownership.

Our final thoughts

If you’ve followed this blog for a while, you’d know we typically don’t like to tell people what to spend their money on.

After all, different people can find different ways to justify their spending.

That said, we’ll make an exception for the car. Why?

According to the 80/20 rule, a.k.a. the Pareto Principle, 20% of your financial decisions will have an 80% impact on your overall financial situation.

In our opinion, a car firmly falls within this category.

You can buy 10 cups of Starbucks a month, and it won’t have as much impact as buying a car.

Same with getting the best cashback app.

Or cooking every meal at home.

Or even buying an overpriced diamond ring.

To make matters worse, it’s a big-ticket item that has been treated by previous generations as a ‘norm’ to have. It’s a testosterone booster, it’s a status symbol; we’ve been taught to desire them from an early age.

This might result in people buying cars simply to keep up appearances.

Our take? You can buy a car. But be absolutely sure you can justify it. This is one of those times you could regret your decision; too fast, too furious.

Stay woke, salaryman.

If you’ve read this far, please consider subscribing to our email newsletter (yes, this Substack). We cannot offer you much but we can offer this:

We have newsletter-exclusive articles that won’t be posted anywhere else. We created these articles for people who want to go deeper into complex issues than the shorter-form content we typically have.

If you don’t have social media or don’t follow our Telegram channel, you can still get updates to all our content emailed directly to your inbox to read at your own time.

We promise not to spam your inbox (but Substack might, so update your notification settings).