The false insurance pitches we’re tired of hearing

*bracing ourselves for angry comments rn* 🫢

This article is brought to you by Havend, a specialised insurance advisory that focuses on transparency and trust throughout the entire insurance consultation process, with an industry-first Money Back Guarantee. Affiliated with Providend Wealth Advisory.

DISCLAIMER: This post explores our thoughts on how policies are pitched; and not on the policies themselves, the use cases for policies differ depending on an individual’s financial situation and circumstances.

Insurance agents have a bad rep. But you knew this already.

And it’s not without reason, too.

Almost everyone has a story about a pushy agent who just can’t take no for an answer. Or how they were sold a policy which had some unexpected surprises.

Tbh, the first one is understandable; in sales people are taught to eat rejection for breakfast and be persistent. The second though, is perhaps something we can shed light on.

In this article, we’ll be unpacking some of the logical fallacies used by insurance agents to sell you policies, or make you buy more insurance than you need.

#1: “Whole life is better than term, which is a waste of money”

For context: There are two types of insurance products out there in the market that pay out if you die.

The first is term insurance, which is cheaper, because you’re only paying for protection.

The second is whole life insurance. It’s more expensive, because it’s a bundled protection - You’re paying for protection, as well as an investment portion. When there is a claim payout or when the policy matures, you’d get the investment portion back in cash.

How it’s pitched:

Some agents will tell you that term insurance is “a waste of money”, because when the policy expires, “you don’t get any money back”.

Whole life insurance? You at least get some money back, so it’s not a waste of money.

What’s the problem:

You indeed get nothing back for term insurance, but this is because it's already significantly cheaper than whole life insurance.

It’s hard to be adequately covered in a cost-efficient manner if you were to buy a whole-life policy instead of a term plan.

For example, for a 30-year-old male looking for $1 million death coverage:

● Whole life insurance may cost $13,000 a year

● Term insurance will only cost $600 a year

That’s a whopping difference of $12,400 a year, or $372,000 over the course of 30 years.*

You could use the money saved buying term insurance to make your own investments outside of the insurance ecosystem, and returns might be similar or even more than what you’ll get with a whole life policy.

The returns from your investments should be able to cover you after your working years, when you are no longer covered by term insurance. You can also use the savings to buy other insurance plans btw (like critical illness plans).

Some might also rather sell you a whole life policy with lesser coverage, rather than a term life policy with adequate coverage. This will be accompanied by a reasoning that it’s better to get covered for life, albeit with a lesser amount.

But there is a big flaw in this approach, in that if death unfortunately strikes, the coverage from a whole life policy will be grossly insufficient.

Further reading: Unpacking ‘Buy Term and Invest the Rest’: Should That Always Be the Case?

*Numbers are based on real-life cases. Stats are provided by Havend.

#2: “An endowment plan is ‘forced savings’”

How it’s pitched:

You’re starting your first job, and you need to get your finances in order. Not everyone is able to have the discipline to save, so if you need help with learning how to save money, then an endowment/savings plan will ‘force’ you to save because of the monthly premiums needed.

What’s the problem:

But… unlike actual savings in a bank account, you won’t be able to access them in the case of an emergency without surrendering the policy (which can result in huge losses).

Also, failing to pay them regularly also means that you’ll be forced to surrender the plan.

While we do think endowment plans have their uses, we think it’s a bad idea to get a fresh grad to commit to paying, say, $300 a month without knowing they can actually do so.

Yes, some will say that these plans do allow you to put your payment plans on hold. They might also say that you get to withdraw some $$$ out of it after some years.

But let’s be real. These are not the features of anything close to real liquid savings. They may also penalise you for doing so.

P.S. Strictly speaking, endowments are technically not even savings, forced or not. They are regular low-risk investments with a lock-in period and high penalties for early termination.

You can also find an investment platform that auto-invests your money into money market funds, bonds or index funds via GIRO so that you’re ‘forced to save’ every month. This gives you more flexibility over your money, while ensuring you still save.

Same same, but different.

#3: “Investing in insurance products is lower-risk”

How it’s pitched:

Funds sold by insurance companies are lower risk than learning how to invest yourself, with a robo-advisor, or with other financial institutions. There are also dedicated fund managers and investment specialists within the insurance company that will ensure your portfolio is being managed well.

What’s the problem:

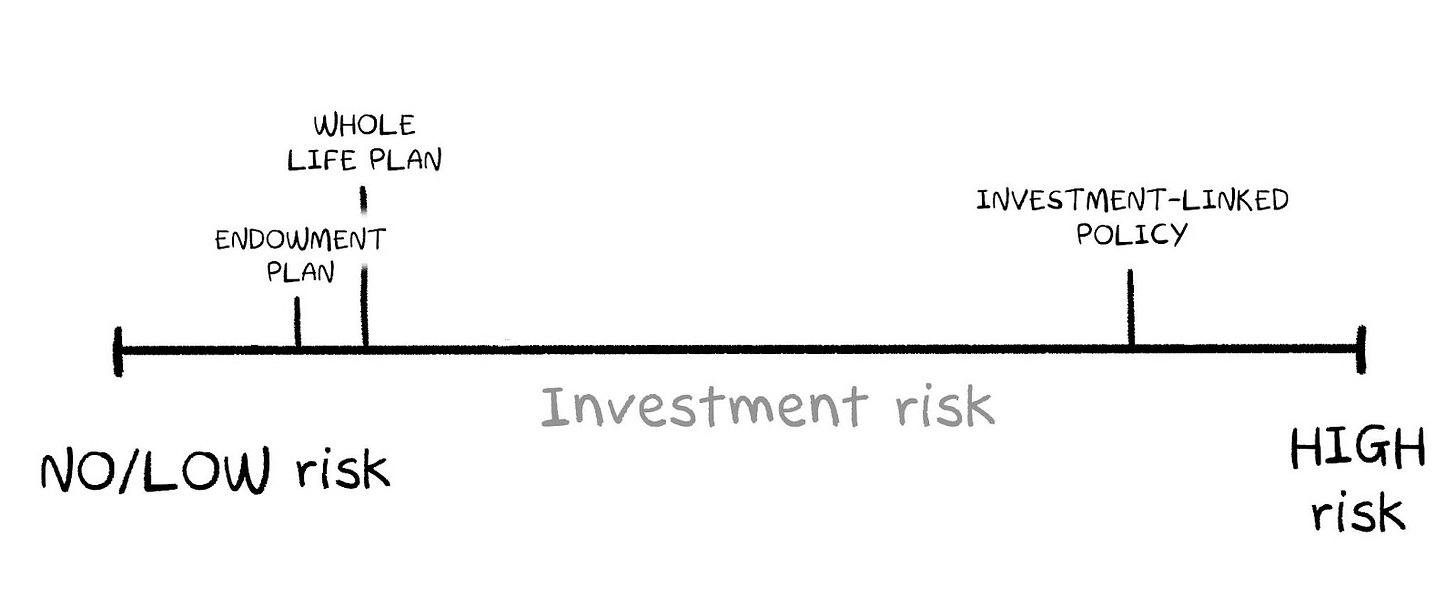

It’s true that certain insurance investments are low risk; plans like endowment and whole-life are often capital guaranteed. However, insurance companies also sell funds that contain equities (a fancy word for stocks) such as Investment-Linked Policies (see below).

These are anything but low risk — and may have comparable risk as investing via other platforms. They’re also not capital guaranteed; some policies might even need additional premium top-ups to sustain investments if they're not doing well.

#4: “Kill two birds, one stone with the investment-linked policy”

How it’s pitched:

Buying an insurance-linked policy (ILP) allows you to “kill two birds with one stone” — providing both investment and protection in one sweet product.

What’s the problem:

Strictly speaking, an ILP doesn’t “kill two birds with one stone”. It’s closer to using two pieces of half-stones trying to kill two birds.

Yes, an ILP has two components: a protection one, as well as an investment one. When you pay a premium, your money goes into paying for both of these things.

However, they’re an inferior option compared to standalone instruments specifically designed for investment or insurance purposes.

If you want to invest, something like an index fund, ETFs or even some unit trusts will charge you less fees. You can often buy the funds offered in ILPs for less fees on external platforms.

If you want to insure, term insurance is a lot more straightforward and easier to understand (see point 1). You can get protection, regardless of how your investments perform.

Further reading: The Truth About Using Insurance for Wealth Accumulation

#5: “Buy whole-life insurance policies for your children”

How it’s pitched:

You can buy whole-life insurance for your child, which will grow in value over time. In the future, your child can also take over the policy and save on life insurance costs.

What’s the problem:

Here’s the thing — the main purpose of life insurance is to protect your dependents financially if you die.

Your children? They have no dependents. They do not need the protection component of whole-life insurance at all.

Buying a whole-life insurance for your child then becomes an over-complicated way to accumulate savings, while also incurring the cost of protection. Hell, even an endowment plan would be better.

And if you want to ensure your child is taken care of, you can consider getting an Integrated Shield Plan (ISP) for them with some Critical Illness coverage* to cater for alternative treatments that are not covered under Cancer Drug List.

*For young children, annual premiums for Critical Illness coverage can be around $1,000 for $200k coverage.

Further reading: Protecting your Little One: A Parent’s Guide to Children’s Insurance

Why does this happen?

Over the course of writing this article, we’ve thought about this a lot.

In our opinion, a lot of overselling/mis-selling stems from insurance agents wanting you to stay within the insurance ecosystem; insurance agents don’t benefit directly when you invest with brokerages or robo-advisors.

Approached from this perspective, insurance, a product originally meant for protection and risk-management, is force-fit to also function as an investment vehicle.

For example:

Instead of getting you to park your savings in a high-yield savings account, customers are encouraged to save via an endowment plan.

Instead of learning how to buy ETFs or index funds, customers are pushed towards ILPs with high fees.

This might work for some people, for sure. But, investing via an insurance company often involves:

1) A long-term commitment with limited flexibility

2) Big penalties if you change your mind

3) Complex plans because of how all protection and investments are lumped together

For that reason, we think it’s important to expand your knowledge. Read sites like ours. Read what other financial bloggers say (even if they disagree with us). Get educated with sites such as MoneySense, Seedly, and other pages.

If you’re engaging a financial advisor or specialist, find someone who really understands your needs and acts in your best interest; this is often not always the first advisor you find. Cross-check their advice with what others say.

“But but but… I just want to leave it to someone!”

…and understandably so.

Personal finance isn’t the most interesting subject out there, so it’s tempting to let someone make the decisions for you. But since your finances touch so many aspects of your life, that’s like letting someone else decide your fate.

You see, learning to manage your money is hard.

Having the discipline to put aside money for savings and investment every month is hard.

But so is making irreversible financial mistakes that you only realise in your old age.

Our take? Choose your hard.

Stay woke, salaryman.

This article is brought to you by Havend

Finding the right insurance advisor (or Havend calls them specialists because they pride their people on being subject-matter experts) can be difficult, because there’s always a fear of being sold policies that you don’t need, or being over-insured.

After all, if insurance advisors can earn more commissions from selling policies like ILPs, it’s inevitable to question if they have your best interests at heart.

(That said, we definitely believe that there are good insurance advisors out there who do put clients first.)

Havend is an insurance advisory firm that aims to tackle these concerns by ensuring all their specialists provide consistent conflict-free insurance advice through a strong emphasis of keeping to their Insurance Philosophy, and they do this through mitigating conflict of interest as much as possible.

Some ways they do this is by:

1. Remunerating their insurance specialists based on lives served, not types of policies sold. This means that their specialists are not incentivised for selling you policies that you may not need, or policies that typically earn advisors more ‘commissions’.

2. Zero sales incentives or sales titles. Same as the point above — they don’t reward their advisors for hard-selling.

3. Providing a money-back guarantee.

In addition to the 14-day free look period, during which you can reconsider your insurance policy purchase, you now can have added assurance of 1 year from the policy inception that if you are oversold an insurance policy by Havend, they will make right and refund any excess premium.

Similar to what we believe in at The Woke Salaryman, Havend also believes in buying term and investing the rest — that insurance is meant for protection, not for investments.

If you want to arm yourself with more knowledge about insurance, you can check out Havend’s eBook of expert tips and real-life stories here.

Or find out more about Havend at https://havend.com/# today.

Im a FA for 14yrs. And an avid TWS reader. Im surprised that you will take up such a piece and write such a single sided viewpoint for a topic that is very dynamic. Articles like this does not educate, it create fear in consumers. Some minority might be spurred to be more hands on with their finances. But the majority end up getting more confused, distrustful and started investing in things they do not completely understand even if no commissions go to an agent. There is a reason why people pay for advice. Please don't paint the industry in a bad light.

The competition between term and whole life, endowments vs investments is already old story... an unbiased FA will know that you need to have a mixture of some into your financial planning. Different family has different needs, budget and financial goals. And many singaporeans are actually risk adversed (probably because they read too many such articles) they end up preferring to stick with low risk endowments. You should write to encourage them to take educated calculated risk on their monies. Whole life is great for people who doesnt wish to continue paying beyond retirement, term as the name implies is meant for a period of time. It is great for boosting coverage when one has dependents and mortgages. Whole life and endowment plans provide guarantees for consumers who are risk adverse. Endowment IS a force savings because there are indeed many people who are poor stewards of money and if given flexibility, will likely squander all their monies before retirement age. Protection planning for children is also different now after the introduction of cancer drug list. Shield plans are no longer sufficient but given the low premium for whole life for children, who can say that term is definitely the best solution for a newborn?

Financial advisors act as a bridge between consumers and solutions, we are solutions providers. What you have written, is a biased opinion.

I worked part time as a Financial adviser and I agree these are on point 👍