If Singapore was a person, it would have $46,400 a year in passive income

Sounds good, but not as good as you might think

The government often struggles with communicating the state of Singapore’s reserves. It’s a complex topic that intersects economics, politics, government and of course, finance.

Do we have too much money?

Or too little?

If we have billions, why are we not spending more?

The reluctance to disclose the actual amount of reserves under management does also add a further barrier to understanding.

But from where we stand, it’s important for Singaporeans to understand this topic. Mostly because it’s crucial for the nation’s survival.

For a resource-poor and small country, being wealthy is Singapore’s only option if it wants to have a voice in a world full of giants.

Make no mistake, wealth is no replacement for oil fields, military might or nuclear power. But it is something that gives Singaporeans – a mere 0.045% of the world’s population – options in this increasingly volatile world.

With that in mind, we thought we’d take a stab at it explaining it simply – as if Singapore were a person.

We also want to be clear: We are not endorsing or condemning how the reserves are managed. That’s beyond our paygrade. All we want to do is to offer an accessible way to understand where Singapore’s finances are at.

A rough estimation of Singapore’s wealth (note, estimation)

We do not know how much Singapore has; but we can make educated guesses.

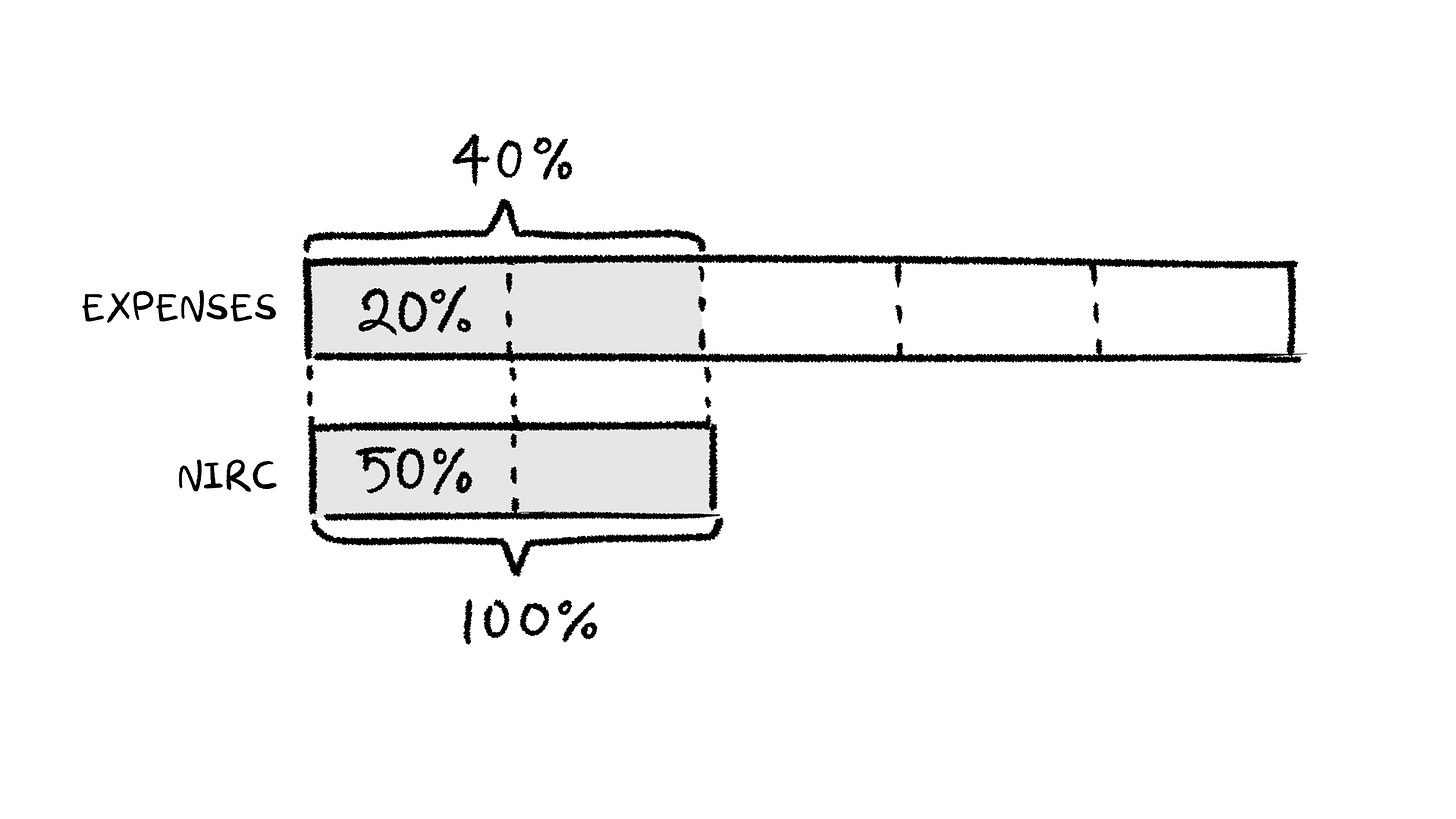

According to the Ministry of Finance, roughly 20% of Singapore’s expenses can be covered by 50% of Singapore’s Net Investment Returns Contribution (NIRC). More on this later.

Written as a mathematical equation, it looks like this:

½(NIRC) = 2/10(Expenses)

NIRC = 4/10(Expenses)

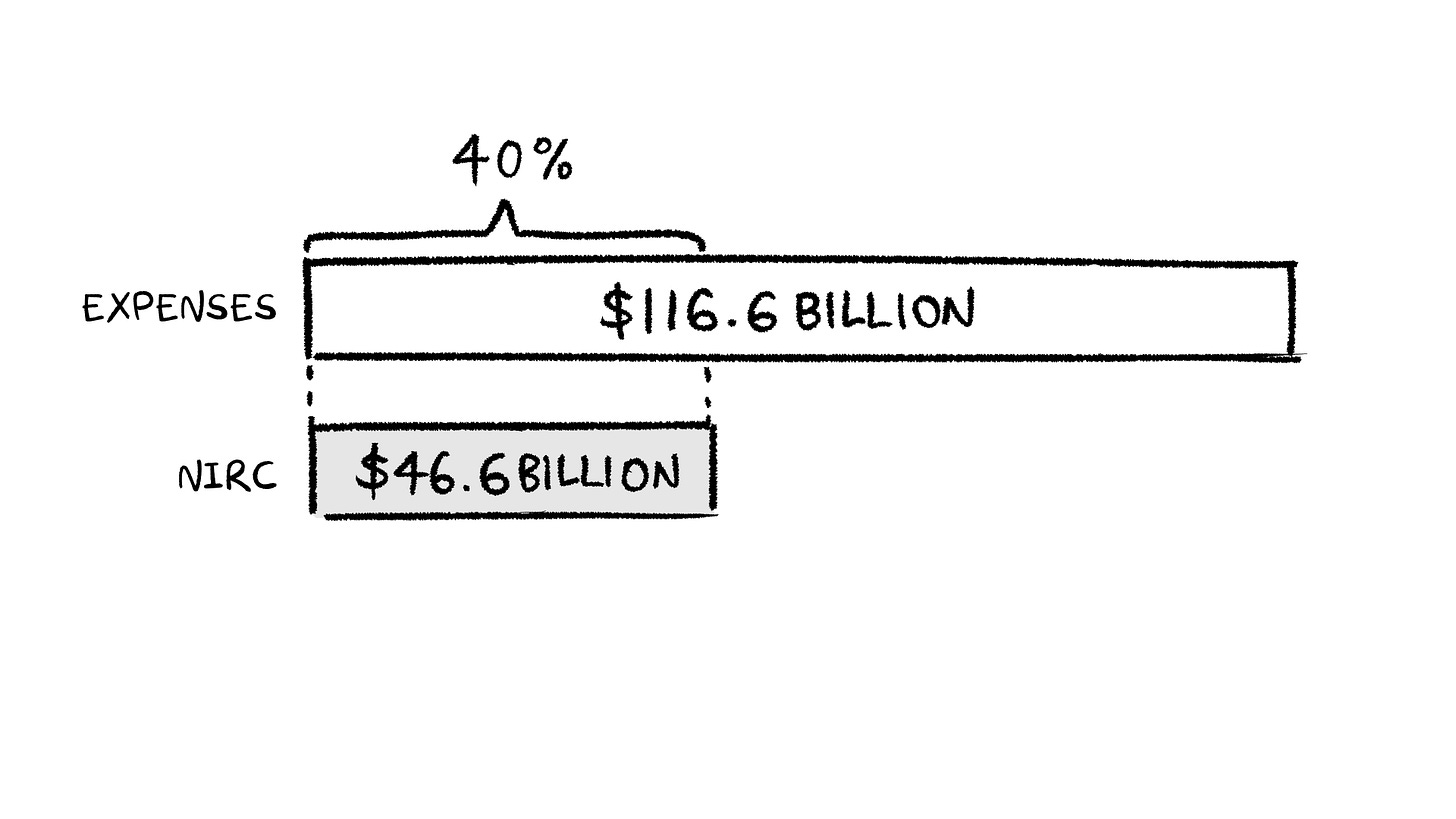

Based on latest figures, Singapore’s expenses were $116.6 billion dollars in 2024.

NIRC = 4/10(116.6 billion)

NIRC = 46.6 billion*

How much in assets are needed to generate $46.6 billion? Knowing Singapore’s risk appetite, we estimate that they’ll go for a stable and steady approach; not exceeding 3-5% p.a. We will use a conservative 4% return rate for our estimate.

Total Reserves (TR) x 0.04 = 46.6 billion

TR = 46.6 billion/0.04

TR ≈ 1.16 trillion

So, based on a 4% return rate, Singapore has 1.16 trillion dollars under management. And is generating $46.4 billion in passive income.

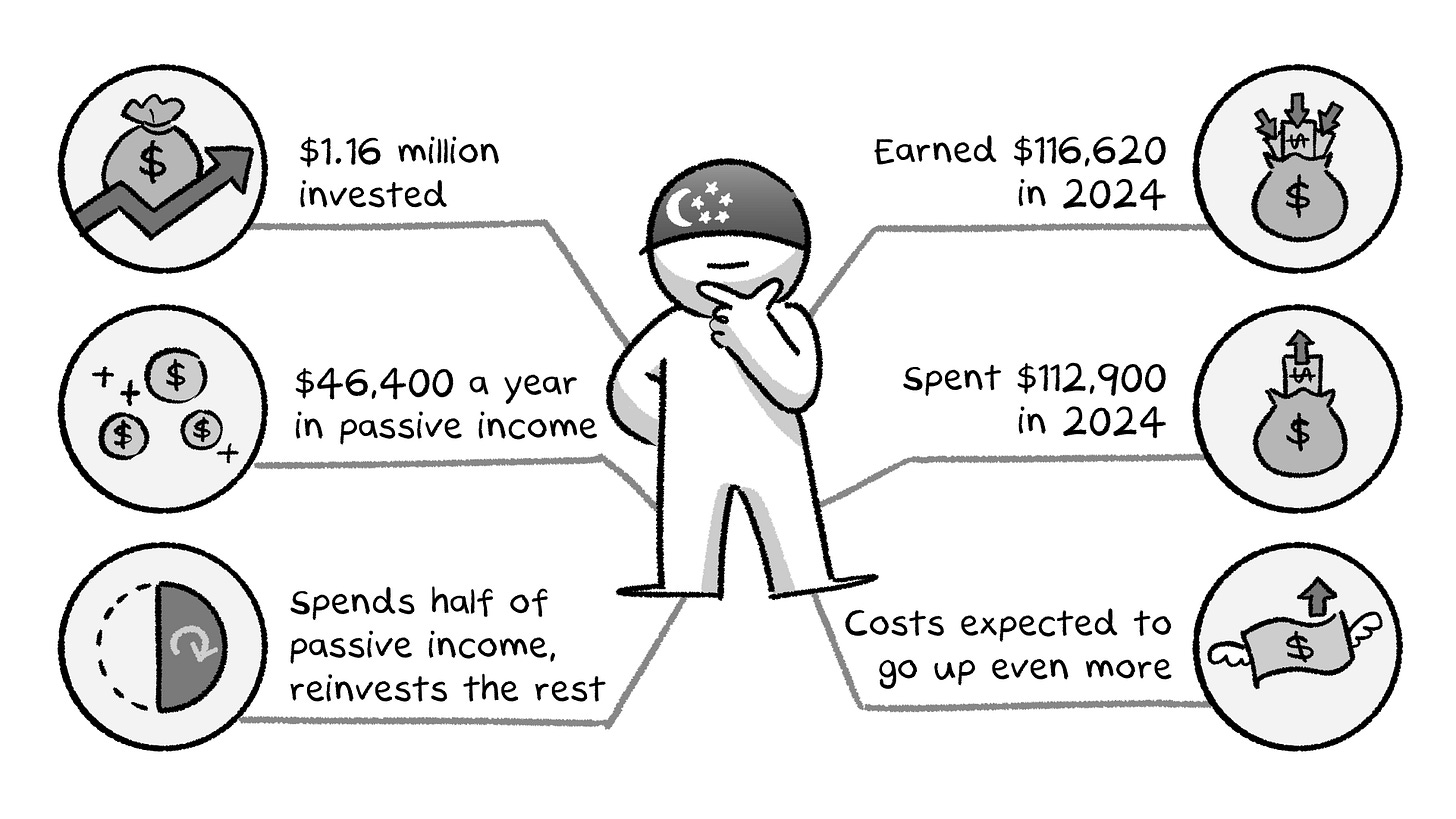

Now, a trillion dollars is not relatable to the average person, so we’re gonna scale that down a million times to figures we can understand.

So that's:

$1.16 million dollars invested

$46,400 a year in passive income

Half of $46,400 is reinvested, the other is spent

($23,200 for both halves)

Those are the numbers and assumptions we will work with for the rest of this article.

*Contribution from NIRC in 2024 was ~S$24 billion. Given that the NIRC is approximately only half of returns, the full return is likely to be $48 billion. The discrepancy between this and our $46.4 billion figure is a result of us assuming a 4% return rate. If we reverse engineer based on the $48B calculation, Singapore has 1.2 trillion instead. But we’re going with 1.16 trillion because we like to be conservative.

Based on this estimation, Singapore is clearly ‘wealthy’

Few countries – even large ones and powerful ones – have reserves of Singapore’s size.

There might be countries with larger reserves, but if we account for population, Singapore is easily one of the wealthiest.

This means it does not need to borrow money to fund its needs. It can actually invest its reserves, earn a return, and use that to pay for stuff. (This return is what is known as NIRC, mentioned in the earlier section.)

That’s a ridiculously good thing.

We have to thank previous generations of Singaporeans for being disciplined enough to set aside this money for us. If not for these investment returns, Singapore would be in serious debt today.

You see, when countries borrow from themselves (by printing more money), or from organisations such as the World Bank, or other countries, there are consequences:

If you print more money, you risk devaluing money that’s already out there. This causes inflation. (See case studies like Argentina, Turkey.)

If you borrow money from someone, they have some influence over you; a say in how you run your life. Same for nations. Think about Greece and the EU, or countries which have been funded by China under the Belt and Road Initiative.

But lest you get smug and think that Singapore can rest on its laurels, hang on just a minute.

Here’s why.

… Singapore’s expenses are increasing

If Singapore was a person, he spent $112,900, and earned $116,620 in 2024 (including returns from his investments).

Without the money from his investments, he would have spent more than he earned ($93,420 vs $116,620).

Why are expenses so high, you ask?

Well… several things are at play.

For starters, many Singaporeans are entering old age, and medical bills have started to spike. Healthcare will remain one of the country’s largest expenses for decades to come.

Another source of expenses is social spending. Over the years, inequality has widened; a large part of Singapore’s budget goes into helping less privileged people close the gap.

But this is only the tip of the iceberg.

If you’ve been following current affairs, you’d know that we’re moving towards an unstable and unpredictable world order. We’re seeing a shift towards a world where absolute power – not rules – guides interactions between countries.

A regional or even global conflict used to be unthinkable. Now, wars are raging across the world. The US, the world’s main peacekeeper, has retreated from its role in recent years. If its interactions with Ukraine are anything to go by, any help will come with (expensive) strings attached.

To make matters worse, there’s also the threat of climate change. Southeast Asia is one of the regions most affected by climate change. And it’s not just stuff like floods, rising sea levels, hotter weather, more rain, etc.

It’s also things like this:

Reservoirs meant to provide water can dry up

Less food produced on farms (prices go up)

More heating needed in cold countries (which means less fuel available)

Investments are helping, but not for long

Let’s recap:

Singapore is a person who has a $1.16 million portfolio, earning $46,400 a year in passive income. If not for his investment returns, he would have to dip into his portfolio.

But as mentioned earlier, his expenses are rising, and will continue to rise in the long term. With each passing year, the passive income will ‘help’ less; it’ll make a smaller dent on expenditure over time.

This is unless, of course, he continues to reinvest returns. He’d be able to grow his portfolio over time – increasing the $1.16 million portfolio to say, $1.2 million or even $1.5 million over time.

A larger portfolio = more returns.

That’s what Singapore is currently doing – it uses 50% of its investment returns to offset current expenses. The other 50% is reinvested to generate more income down the road.

A recap of Singapore’s (as a person) finances:

Spend or invest?

That leads us to what people debate about: should Singapore reinvest less returns, and spend more? Or should things remain status quo?

Some want Singapore to spend more in the short term to help with today's challenges; namely the rising cost of living. They want to invest in systems that will help the less fortunate overcome inequality. So people don’t get left behind.

These are worthy, important and meaningful goals, even from an economic standpoint.

Singapore’s only resource is its people. The further people fall behind, the more expensive it will be to get them up to speed later down the line.

If Singapore cannot even thrive in the short term; why think about the long term?

And here’s the other argument: Singapore lives in an increasingly volatile world, and the extra money will be worth its weight in gold. Today’s cost of living has gone up for sure, but it’s not an existential threat – at least compared to war, climate change, and pandemics.

So if you deplete your savings now, it will generate lower returns.

You’ll enter a vicious cycle of lower savings, lower investments, and lower returns. But accompanied by higher expenses. If this goes on long enough, Singapore will deplete its vast fortune.

What should Singapore do?

If we put on our personal finance hat, we’d probably lean toward the cautious route: live below our means, reinvest our passive income, and grow our portfolio. That’s personal finance 101.

But here’s the thing — Singapore isn’t a person.

We used this analogy to make complex national finances easier to understand, but let’s not confuse a metaphor with reality.

For a country, ‘living below your means’ can be impossible for certain segments of the population who’re already trapped in the poverty cycle. Fiscal responsibility is important, but it shouldn’t happen at the cost of people. (Singapore has shown it understands this, as observed most recently when it dipped into its ‘retirement funds’ to combat COVID-19.)

On the other hand, countries face pressures that individuals don’t. They have to maintain national security, manage public sentiment, deal with geopolitics, and prepare for 100-year problems like climate change and demographic collapse.

So yes, treating Singapore like a prudent, investing-savvy uncle helps frame the issue. But the real decisions?

They’re messier, higher-stakes, and come with no redo button.

Here’s to hoping we make the right choices.

Stay woke, salaryman.

If you’ve read this far, please consider subscribing to our email newsletter (yes, this Substack). We cannot offer you much but we can offer this:

We have newsletter-exclusive articles that won’t be posted anywhere else. We created these articles for people who want to go deeper into complex issues than the shorter-form content we typically have.

If you don’t have social media or don’t follow our Telegram channel, you can still get updates to all our content emailed directly to your inbox to read at your own time.

We promise not to spam your inbox (but Substack might, so update your notification settings).

Beautifully written. Most people don’t understand how it works and it’s seen during the elections where everyone is just fighting for low GST, low housing price but more money for the people. The money just has to come from somewhere…

Healthcare costs are among the highest. And health insurance is a factor for the increase. Is there more than can be done to reduce the expenses ?