The insurance questions you’ve wanted to ask but didn’t dare to

How do insurance agents get paid? Why are there surrender charges? Why must I share so much sensitive information? All these questions answered and more.

DISCLAIMER: This article is sponsored by DBS. You can now consolidate and view all your insurance data on digibank via SGFinDex.

You’re 23. Your long-lost friend turned financial advisor has asked to meet you to catch up. Obviously, you know it’s a sales pitch.

After ignoring them for weeks, you bravely decided to meet them at the neighbourhood Starbucks.

After an adequate amount of small talk and niceties – ooh! What was life for you like after poly?! hahaha – they whip out their iPad and begin the sales talk.

You awkwardly disclose your salary and life savings as they run through a checklist of things. They talk about how it’s good to get insurance early because it’s more expensive in the future.

They ask you which coverage you need and you say, ‘just the most basic one.’ You are recommended several policies; a life plan, a critical illness plan, and something they call a savings plan.

The math says you’ll be paying about $550 every month. Those are shockingly high numbers for a broke 20-something-year-old.

Your mind is filled with questions:

Why do you even need these policies? I’ve heard most people don’t even get to use their insurance.

“How do you determine how much coverage I need? Are you scamming me?”

“How come I must pay a surrender fee?”

“How come I pay so much and might not get anything nothing back?”

But you say nothing.

Some of these questions are too outwardly aggressive in non-confrontational Singapore. Others are too ‘dumb’ and you don’t want to be judged.

You smile. Nod your head. You might even sign the papers, after all, there’s a free look period – you can always cancel later without feeling paiseh.

In fact, you’ll probably cancel the policy and ghost your friend afterwards. It’s easier that way.

We’ve heard this scenario recounted by both financial advisors and their customers, again and again, and again. These encounters help no one; customers don’t walk away protected, and FAs don’t get to make a sale.

So to help everyone along, we’ve compiled some often-pondered, but rarely-asked questions about insurance.

We hope they clear stuff up, resolve confusion, and help you make clearer decisions.

I pay for insurance but don’t get my money back. Isn’t that a waste of money?

Before we go into this, let us give y’all a quick TL;DR of the different life insurance policy types.

Many people feel like insurance is a waste of money, because they’re paying for policies they might never make a claim against.

This often leads them to shun term insurance in favour of a whole-life plan, which has a cash value. The reasoning is that “at least I get something back.”

This is flawed thinking because of two reasons.

First of all, while a whole life plan has cash value, they’re also more expensive because you’re paying for that cash value.

The second reason is this: Just because you’re not making a claim, does not mean you’re not using it.

Here’s an analogy: Suppose you hired a bodyguard. During the time that the bodyguard was hired, you were not attacked. Does that mean the bodyguard doesn’t need to be paid?

Of course not!

How do insurance agents estimate what coverage I need?

In insurance agent school, there are generally a few ways they’re taught to calculate how much coverage you need.

This is particularly true for stuff like Life Insurance, as well as Critical Illness Insurance.

For Critical Illness, most agents will recommend that you have enough coverage to tide you through five years.

Why?

This is based on how long it takes for someone to recover from serious illnesses, including post-surgery treatment, rehabilitation and follow-up care. The insurance payout is meant to replace any income you’ve lost during this period, and goes towards covering your medical bills and life expenses.

Life Insurance? It’s slightly more complex, with several schools of thought.

Multiple method: taking one’s yearly gross income assumed to be payable till retirement age, and multiplying it by a certain figure (e.g. 5-7 times) with inflation factored in.

Capital needs method: based on the income needed by one’s dependants to maintain their current standard of living.

Arbitrary method (TWS: not recommended): based on how much you want to leave to your dependants

Why are the surrender fees so high for early cancellation?

Why do you have to incur a surrender charge when you cancel your policies early?

Well, here’s the truth, from a business perspective.

At the point where you sign on a policy, the insurer hasn’t made money from you yet. Instead, your premium goes into covering the cost of keeping the policy; this includes staff costs, such as the commission your agents received.

When you decide to terminate your policy, you’re creating a loss for the insurer; which is why they’ll take a sum from you to make up for that loss.

However, if you hold your policy until the insurer breaks even, then you won’t incur a surrender charge.

Why do insurance costs increase the older you become? Why do they refuse to cover some people? That’s so unfair.

Statistically, older people are more likely to have health issues than young people. Insurance is a business involving risk management.

The riskier the client, the more likely they are to make claims, and the more likely they are to cause the company a loss.

Similarly, if someone already has a pre-existing condition, it makes the odds unfavourable for the insurer to cover.

Doesn’t that mean insurance companies are trying to make money out of me?

Here’s one truth you have to accept.

If insurance companies did not make money out of most of their customers, they wouldn’t exist.

In fact, insurance companies work because most people will not have incidents happen to them.

This is a concept known as risk pooling.

It is unlikely that everyone will have a critical illness at the same time, which is why critical illness insurance can be a sustainable business.

Most people will not have an accident happen to them in their lives, which is why accident insurance can be a sustainable business. So on and so forth.

So, why buy insurance then? Because out of the hundreds and thousands of customers, there will be someone who gets unlucky.

And if that someone is you, chances are you won’t be able to afford the costs of being unlucky, and you may even cause financial strains on your dependants.

Why must I share so much sensitive information?

If you’ve ever tried getting a blanket quote for a certain policy from your insurer, they would have replied with a request to meet up and to get all your financial details.

Questions they would ask include:

How much do you make and spend every year?

How many dependants do you have?

Are you in any debt?

Do you invest?

What is your lifestyle like?

Do you have any history of family illness?

I’ll be first to say I hate sitting down with some acquaintances and giving them information often reserved for my loved ones. But there are two reasons this happens.

The first is something we mentioned earlier: The insurer is doing an assessment on you, to make sure you’re not too risky to insure, and to figure out what your risk appetite and capacity are.

The second is because insurance agents or Wealth Planning Managers need this information to give you good guidance on what and how much insurance you need!

Everyone’s finances are different, what might work for your friend, might not for you and vice versa.

For example: If you have no dependants, no mortgage to pay off, you will need less coverage compared to someone who’s the sole breadwinner of a family of eight, who just bought a $1,000,000 HDB flat.

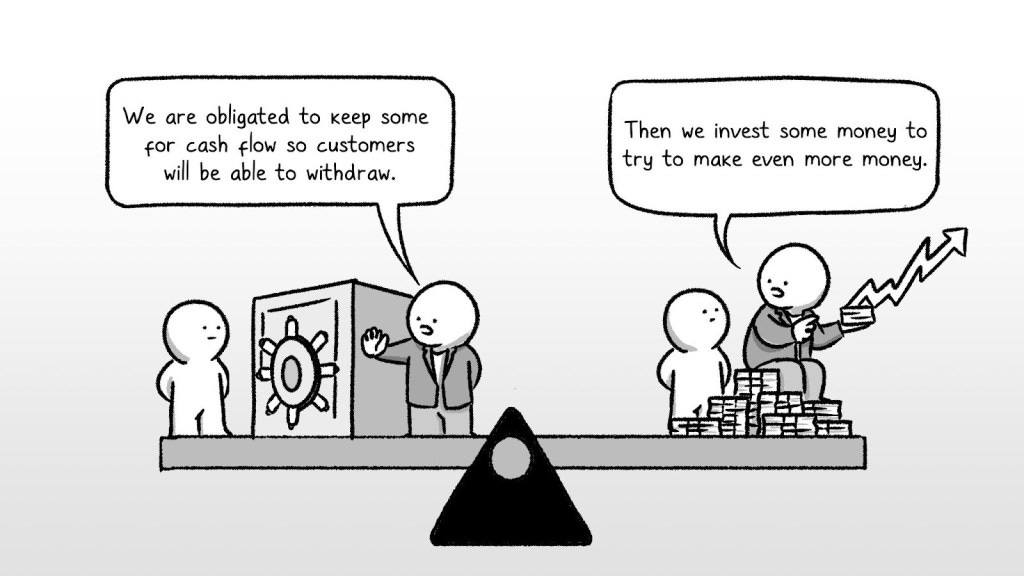

Good to know: How do insurance companies make (and lose) money?

Insurance companies make money by balancing two things.

Invest the premiums you’ve paid them to make a good return.

Making sure they always have the cash flow to keep to the promises they’ve made their customers

For example:

If you pay your insurer $1,000 a year for a whole life policy that guarantees 2.5% interest, they’ll try to invest this $1,000 to earn more than 2.5%. Let’s just use 10% as an example.

If they are successful, they’ll give you 2.5%, and keep 7.5% for the business.

An insurance company loses money either when their investments don’t do well (they make a loss on investments, but have to pay you 2.5% anyway), OR when they have to pay out a lot of money due to an unforeseen incident.

Classic example: The payouts that had to be made after September 11 dealt the insurance industry with huge losses because it was an event that companies did not predict and account for.

Don’t let the fear of looking dumb prevent you from sorting out your finances

Everyone starts off in personal finance as a noob. It took us years and years to learn this stuff, and even then, we don’t consider ourselves experts. Far from it.

There’s no shame in asking questions, especially about something as complex, unintuitive and high-stakes as insurance. In the absolute worst-case scenario, you’ll get a chuckle or two.

That is far better than overpaying for your insurance for decades, or finding out you lack coverage when you most need it.

Both of these can have irreversible consequences.

Perhaps Confucius puts it best:

The man who asks a question is a fool for a minute.

The man who does not ask is a fool for life.

Stay woke, salaryman

To get a clearer picture of your insurance, check out DBS NAV Planner

We get that going into conversations about insurance can be tricky - it feels like you may be getting the shorter end of the stick, or you may be forced to get something that you don’t want.

But this doesn’t mean that we should ignore insurance altogether.

With DBS NAV Planner, you can now view all your insurance data from participating insurers via SGFinDex, and get advice based on your existing insurance policies and financial situation, tailored just for you.

No upselling, no awkward conversations.

Just recommendations that help you to navigate through your insurance journey with more confidence.

Link your policies with DBS NAV Planner today. Find out more here.