The TWS guide to 100k by 30 goal

It has been three years since we talked about the 100k by 30 goal. What has changed since then?

WARNING: THIS ARTICLE IS SPONSORED BY STANDARD CHARTERED JUMPSTART ACCOUNT. IT IS WRITTEN TO ANSWER FREQUENTLY ASKED QUESTIONS FROM OUR READERS ABOUT 100K BY 30. DO NOT PROCEED IF YOU ARE NOT INTERESTED. We are not saying every young person should aim for this, and those who don’t are lousy or unambitious. Answering a Frequently Asked Question is NOT THE SAME as advocating for general society to adopt something.

Wait, wait, wait. Hang on.

Before we get into things, I just gotta speak to the people who might be triggered by this article’s title.

We get it. Saving $100,000 by 30 is not a goal that everyone might have. And this goal might be out of reach to you because of a variety of reasons, including

Different goals (family, travel, fun, etc)

Different starting points in life

You might have read some variation of this content before, and feel that you have achieved less. This is not true, so please don’t beat yourself up over this.

Blindly following any financial goals other people (us included) have can be a path to an unhappy life.

All that being said, there are people who want to achieve this goal. And they do read this blog.

So this post is for them. You may opt not to read this if you don’t like this goal.

…

…

…

(If you’ve made it past this point, I’ll assume that you’re looking for an instructive guide of some kind to save $100,000.)

But first, why $100,000 by 30?

To be absolutely clear, there is nothing particularly magical about the number $100,000, nor the age 30.

Though I suppose you could make the argument that it's an easy number to remember, and achievable by the end of your 20s – this is opposed to say, $80,000 by 28, or $400,000 by 40.

Why amass $100,000 at such a young age? For me, it was a prelude to retiring early. I’d invest this $100,000 to earn returns off it.

However, how you choose to spend your money is up to you.

Do you need family money to reach this goal?

In my experience, no. Unfortunately, I did not receive any money from my parents at 30 to help me reach this goal.

However, my parents were far-sighted enough to look after their own needs, which meant that apart from giving them an allowance, I had relatively few financial burdens.

It also helped that I started off with no debt, as I had a scholarship which paid for my higher education.

Keep in mind that the worse off your starting position in life, pursuing this goal might take you more time, more risk, or both.

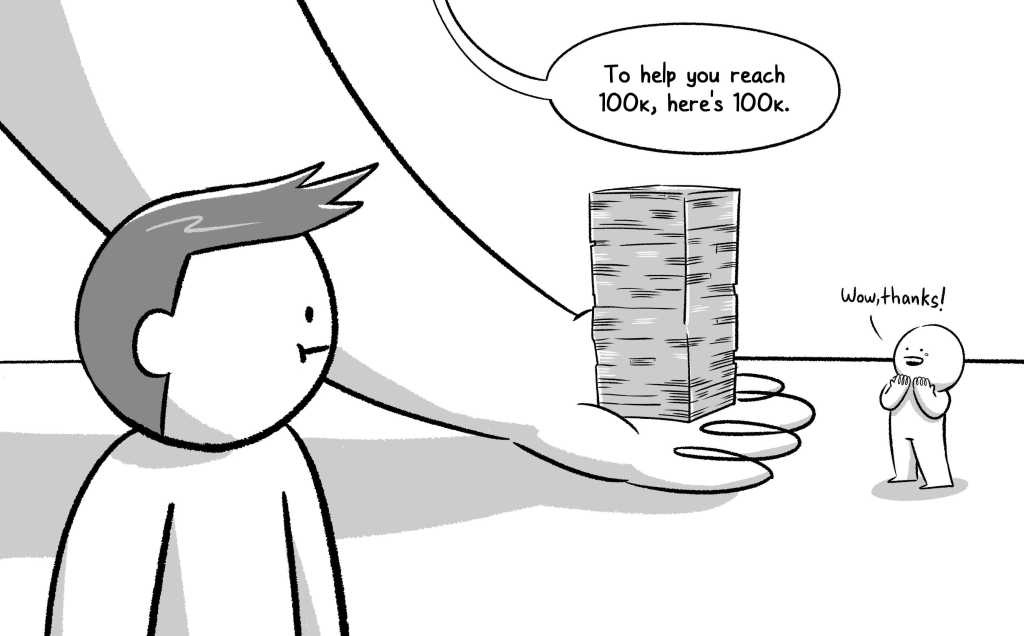

What assets are included in the ‘100k by 30?’ goal?

The original goal I set in 2014 was to accumulate $100,000 in cash and other investments (excluding CPF).

You include:

Cash

Stocks

Bonds

Cash value of any whole-life or endowment plan

Paid-up capital in a property (the $20,000 you’ve put into your HDB flat counts)

Any non-housing debt

The resale value of other assets (i.e, a car that can be sold)

You exclude:

CPF (OA, SA, MA)

Money spent on renovation

Money spent on experiences

Why did I exclude CPF? Well, since my goal was an early retirement at 35 years old, my CPF would have still been locked up.

(However, over time I’ve come to accept CPF as part of my net worth.)

How to reach 100k by 30?

Unlike what many financial content creators would have you believe, I found that solely relying on investing alone to get 10x or even 100x returns is not the most feasible way to amass $100k by 30.

Instead, we find that going back to the basics is more important

Here are the three most important rules.

Maximise your earning power

I started life as a salaryman, earning $2,700 at my first job in 2014 at 25. In 2018, I was earning $7,500 per month at 29.

* But does not indicate the amount saved from side hustles and freelance writing, which is considerably unstable and unreliable. I estimate I aimed for $1,000 a month for side hustles but in reality, this was not as consistent.

Make no mistake, earning an above-average salary involves making specific career choices to get as much salary as possible. In my experience, these often (but not necessarily) mean:

Taking on more responsibility and risk

Taking on more work (including freelance work)

Choosing a profession less based on passion or purpose, and more on salary

Negotiating salary often and potentially leaving if better opportunities arrive

You might notice that I still managed to cross the $100,000 mark despite I was earning below the median salary when I was 28. This brings me to my next point.

Spend lesser than you earn; live below your means

For the first years of my working life, I continued living like a student. I lived at home with my parents, spent little on holidays, alcohol, dates, and pretty much everything else.

*Excludes insurance and parent’s allowance, which I paid for with freelance $$$.

Putting your money to work

Just this October, the core inflation rate rose up to 5.3%.

This means that even if you hit the $100k mark, putting it in a regular savings account that gives you a 0.05% return will erode the value of your hard-earned savings eventually.

To start off, you can consider putting your cash in a high-yield savings account. For instance, our sponsor, Standard Chartered JumpStart, offers up to 2.5% p.a. interest on your balances of up to $20,000.

With the rest of your money, there’s the option of investing in other things that can give you higher returns, such as

Stocks

Bonds

Unit Trusts

ETFs and Index Funds

Property/REITs

(But of course, higher returns also come with higher risks too. Don’t invest what you cannot afford to lose, and remember to always ensure you have sufficient cashflow for your living expenses.)

What will pursuing this goal cost you?

Make no mistake. Putting your life’s focus on accumulating wealth will involve many trade-offs.

Maximizing your earning power often means spending most of your time working. Saving large proportions of your income will mean many normal recreational activities will be out for you.

Here are some things I’ve experienced myself as a result of pursuing these goals.

Failed relationships due to different values of money

Heaps of FOMO when you see your friends doing stuff they love

A loss of physical health due to immense work stress and lack of exercise

Affected mental health due to a lack of support network and community who shares your goals

To be honest, these reasons combined are more than enough to put most people off pursuing this goal. What you will gain in money, you will lose in certain areas. And vice versa.

All that being said, I have no regrets pursuing this goal. 100k by 30 prepped me for the COVID pandemic and allowed me to focus on my physical and mental health.

But we know that this hustle isn’t for everyone too. If you’re on the journey of hitting 100k, remember to go at it at your own pace, and prioritise your well-being while you’re at it.

Is ‘100k by 30’ still relevant as a financial goal in 2022?

The first time I wanted to save 100,000 was in 2014, eight years ago. Between then and now, tons have happened.

There is indeed a group of people who think ‘100k by 30’ is easily achieved and in some ways, mediocre for someone pursuing financial independence.

Here are some reasons why they might think so:

The extremely bullish markets of 2020 - 2021. Crypto and a bullish stock market have given a group of Gen Y and Zers a relatively easy way to get rich quick. Staying rich, well, is another matter.

Many people started to become more financially savvy. An explosion of personal finance and investing content since the pandemic has made people start investing/saving younger and younger.

I started my financial journey at 25 and reached my first $100,000 when I was 28. This means it’s possible some 24-year-olds reading this article today can reach do the same thing by the time they’re 28!

Inflation and the devaluation of money. It's hard to estimate how much inflation happened during the COVID years. However, what is clear is that $100,000 can buy you fewer things than say, 3-5 years ago.

Here what’s $100,000 by 30 looks like in 2022 if we factor in inflation:

What’s after 100k by 30?

Everyone has different goals in what they want to achieve in life. I can’t speak for everyone, but these were my personal milestones after reaching $100,000 at 28.

$200,000 by 30. Since I had reached $100,000 ahead of schedule, I wanted to see if I could double my initial goal when I was 30.

$500,000 at 35. Earning 4% p.a with this amount would generate about $20,000 per year. This would be approaching what people consider enough for BARISTA FIRE in Singapore.

$1,200,000 at 40. Earning 4% p.a with this amount would generate $48,000 a year, which is around $4,000 a month. IMO, having $4,000 in disposable income is more than enough for fulfilled life – so at this level, I would say I am ‘financially free’.

$2,000,000 (possibly above 40) will allow you to withstand a 40% fall in asset prices, and still be considered ‘financially free.’ Provided you don’t inflate your lifestyle too excessively.

(In all honesty, I don’t have any financial goals beyond this.)

Is 100k by 30 causing unnecessary pressure?

One of the unintended side effects of our initial article is that it has made $100,000 by 30 seem like it’s the norm.

Some people have told us that it has diminished their self-worth for not reaching that milestone.

We apologise for that, it was not intentional.

Here’s what you can think of it as.

Saving 100k by 30 goal is kinda like running a marathon.

Running a marathon is hard, no doubt. It is clear that not everyone can do it. Especially if you take into account, age, gender, physical and mental conditions, etc.

That said, a large number of people, should they dedicate enough time, training and effort can reach it.

Yes, it will involve significant lifestyle changes and sacrifice. But it's difficult. Not impossible. That’s an important difference.

Would you feel terrible about not being able to run a marathon, because you chose to do something else with your time?

I wouldn’t.

Similarly, many people achieve different goals instead of choosing to pursue $100,000. Some people raise families, support their siblings, or buy their dream car.

Rather than fixating on reaching $100k by 30 – or some variation of it – it’s far more important to set your own goals in life.

This doesn’t just apply to financial goals, but pretty much everything.

Moral of the story is? Choose your goals. Make your own decisions. And bear the consequences of your actions. Because there will be.

Everything else is just noise.

Stay woke, salaryman.

A message from our sponsor, Standard Chartered JumpStart Account

If you’re looking to jumpstart on your financial freedom goals, you can consider Standard Chartered’s JumpStart Account as a base to grow your money safely without jumping through many hoops.

In the world of high-yield savings accounts that reward you with higher rates the more you transact with them, SC Jumpstart stands apart with its straightforward requirements. You just have to be between the ages of 18 - 26 to open an account.

2% p.a interest on your first $20,000 by simply depositing your money. No lock-in, no minimum spend, and no salary crediting needed.

Additional 0.5% p.a interest on your first $20,000 when you invest

If you’re above 26, you can also consider a Standard Chartered Bonus$aver Account that gives you up to 4.88% p.a interest.

To find out more about Standard Chartered’s banking products, check out www.sc.com/sg.