10 Revelations That Helped Me Rethink My Finances In My 20s

Some things you read about. Other things you learn from experience.

This article was first published on 3 March 2020. We believe it’s an oldie but a goodie and want to share it again for our new readers who have just discovered our page.

We often get questions from people about whether they have enough money at their age.

These are questions like “How much money should I have at 25?”, or “I don’t have 100k at 30, will I be okay?”

My humble opinion is that when you’re young, how much money you have in your bank account doesn’t matter as much as the way you think about money.

That’s why instead of putting the focus on how much I saved each year, this article is about the major life lessons in my 20s and how I came to learn them.

If you’re reading all these when you’re in university, then you’re in a great position to avoid most of my mistakes. Because learning from experience sucks.

Now, before you continue, I want to make things clear that this article isn’t “do all these things and be rich,” but more of “here are some helpful things to keep in mind while you try to be financially free.”

1. Every $100,000 saved is one month not working.

At my first job in 2014, I realised that indeed the adults were right and “money is hard to earn.” The transition from being a student to a salaryman was hard, and I sought the fastest way out of working life possible.

(These led me to these life changing articles by BudgetBabe, The Straits Times and the The Motley Fool.)

I figured that for every $100,000 saved, I could generate maybe $4,000 in passive income. Each $4,000 would mean one month without working. To stop working for six months, I’d need $600,000.

Six months off every year. Wouldn’t that be amazing?

I decided to take on as much freelance work as possible to help me reach that first $100,000.

Further reading:

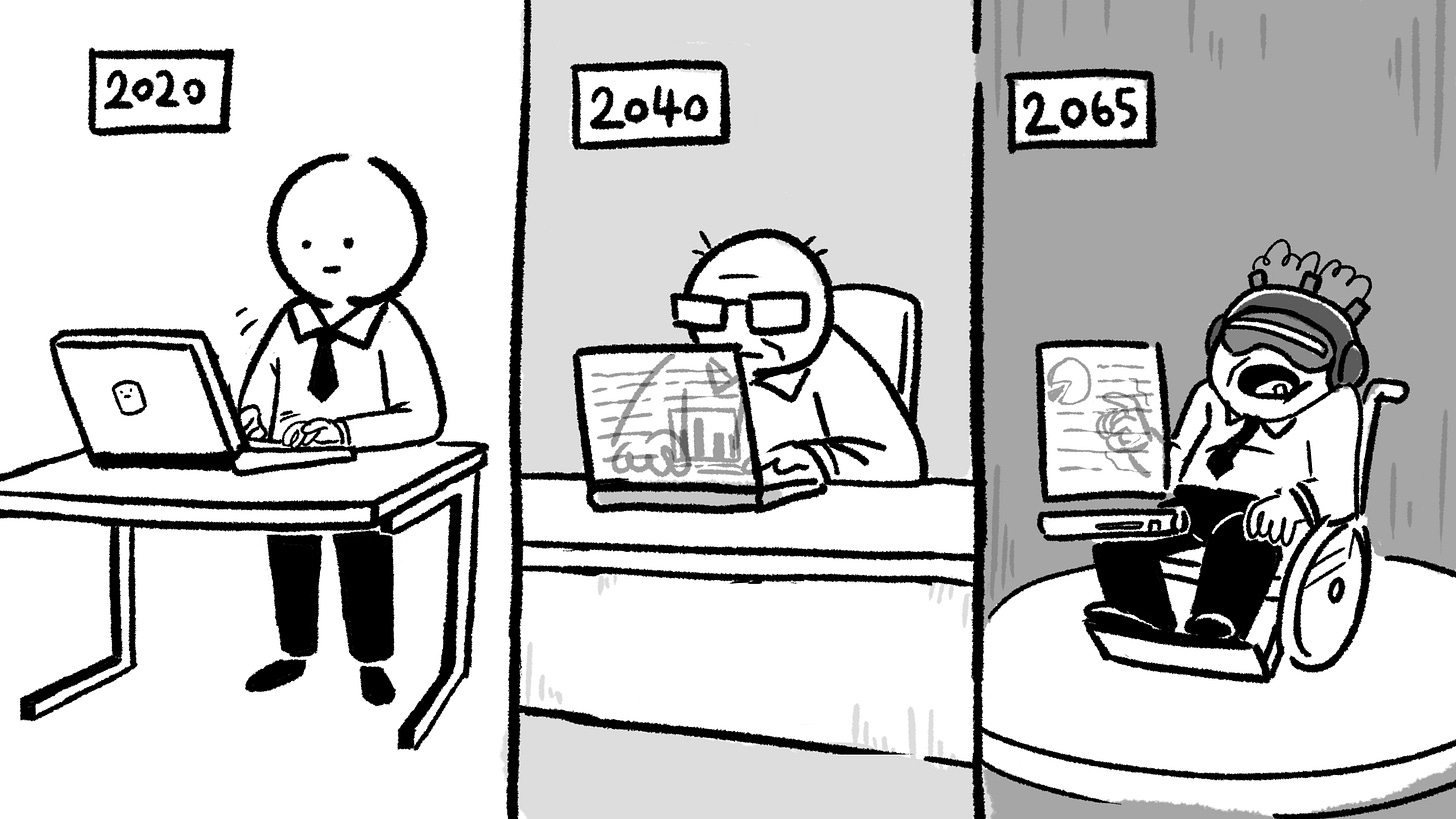

2. Working till old age was something I’d like to avoid.

My mom had a crippling stroke in 2014 which left her unable to bathe, eat, or walk by herself. She was 59. This was an event that shaped my perspective on life tremendously.

Armed with nothing but two PSLE passes, my mom had worked immensely hard for 40 years. She hustled hard to give her kids the best life possible, and insisted on working long after we grew up because she wanted additional financial security.

Now, she would never go on holidays or those morning jogs she so enjoyed for the rest of her life.

Seeing this made me realise I wanted to quit the rat race with enough of my health intact. This also pushed me towards the F.I.R.E. movement.

The idea was to secure financial freedom early, then work at a leisurely pace doing work that made me happy all the way till I die.

Further reading:

3. If you don't have money, you might be stuck working for shitty people.

My earliest side hustle was to work at a cafe on weekends for about $6 an hour. I earned about $48 per weekend.

The pay was miserable but I had no other skills. The boss monitored staff through a CCTV, verbally abused his staff and was generally a rich entitled brat. (He could afford the cafe because his dad had given him some seed funding.)

This made me see firsthand how important it is to have the choice to walk away, whether by finding another opportunity or by not having to rely on employment for a living in the first place. So I swore to become financially secure so that I could always choose who I worked for.

Further reading:

4. Longer hours don’t mean higher pay.

Towards the end of 2014, I joined the advertising industry, famed for its long working hours. My colleagues were fun, the clients were not terrible, and I had a great boss, but pulling multiple all-nighters made me discover the law of diminishing returns.

Whether or not I worked 8, 10 or 16 hours, I was only going to get $3,000 a month because that’s how most companies work. Even if your boss wants to give you an increment, some HQ office in Paris will say, “No, he needs to follow the progression like everyone else.”

So it simply didn’t make sense to spend too much time at work after a certain point.

Afterwards, I made it a point to leave at 9pm on the dot everyday. Not exactly 9–5, but it was a start.

Further reading:

5. Your day job isn’t the only way to make money.

I tried my best to establish a reputation as a copywriter who was fast, effective and hardworking. This needed a lot of work, but eventually paid off.

About a year after this, people started approaching me for last minute jobs. The deadlines were tight, but they paid really well — some up to $5,000.

Was I going to pass on a $5,000 job when I only earned $3,000?

Hell no. I burnt weekends, weeknights and endured multiple rounds of client changes to get things done.

It was then that I found out people can actually earn more from side hustles than their day job.

Further reading:

6. When you start from zero, building capital is more important than making the best investments.

In 2015, I plonked my first $5,000 into the stock market. I bought Raffles Medical based on faulty logic that medical companies would always do well.

Perhaps because it was my first time, I spent hours monitoring the stock market like a hawk and had sleepless nights when the price dipped. Eventually I realised I had no business to be actively investing when I had hardly done my research.

The time that I spent fussing and stressing over a few hundred dollars? I could easily have worked on several freelance articles to earn money that was a guarantee.

I sold all my stocks and went into index investing, focusing on improving my earning power instead.

Further reading:

7. Challenge the norms of society and there will be rewards.

I started cycling to work in 2016. It was really awesome. I got a lot fitter and saved some money — but at the same time I felt like a deviant in a society where everyone shunned cycling and worshipped the car-driving executive.

Admittedly, I didn’t save a lot of money from this exercise. I wasn’t going to buy a car anyway, and I spent $1,000 a year on public transport, max. I could have jogged to lose weight, which was free of charge, too.

But other than helping me save time by combining fitness and commuting into one, this exercise helped me see that certain traditions/norms in society — such as car ownership — were either no longer practical or a huge waste of money.

The lesson I learnt is: If you want to achieve anything quickly, be prepared to do the things others are unwilling to do.

Further reading:

8. We live in Singapore. There’s no avoiding money in relationships.

I’ve had my fair share of failed relationships in my 20s. And I’d say many of them imploded because of my attitudes towards work, retirement, and money.

Let me first say that I totally understand where they’re coming from. For most people, the idea of early financial independence is really attractive. But the lifestyle change it involves is often unacceptable.

Most people, for example, prize their weekend cafe-hopping excursions or staycations. Dining out in a nice restaurant regularly is important, as are gym memberships and new clothes. And they’re not wrong at all for wanting so.

However, pursuing early financial independence means scaling back significantly on some of these things in your 20s. The more you can scale back, the faster you can attain it. But of course, doing so might mean a partner feels neglected or unwanted.

What I got from the entire episode? If you’re after a serious relationship, it’s important to talk about financial goals.

It also made me realise how hard it was to find a partner that was also financially ‘woke’.

Further reading:

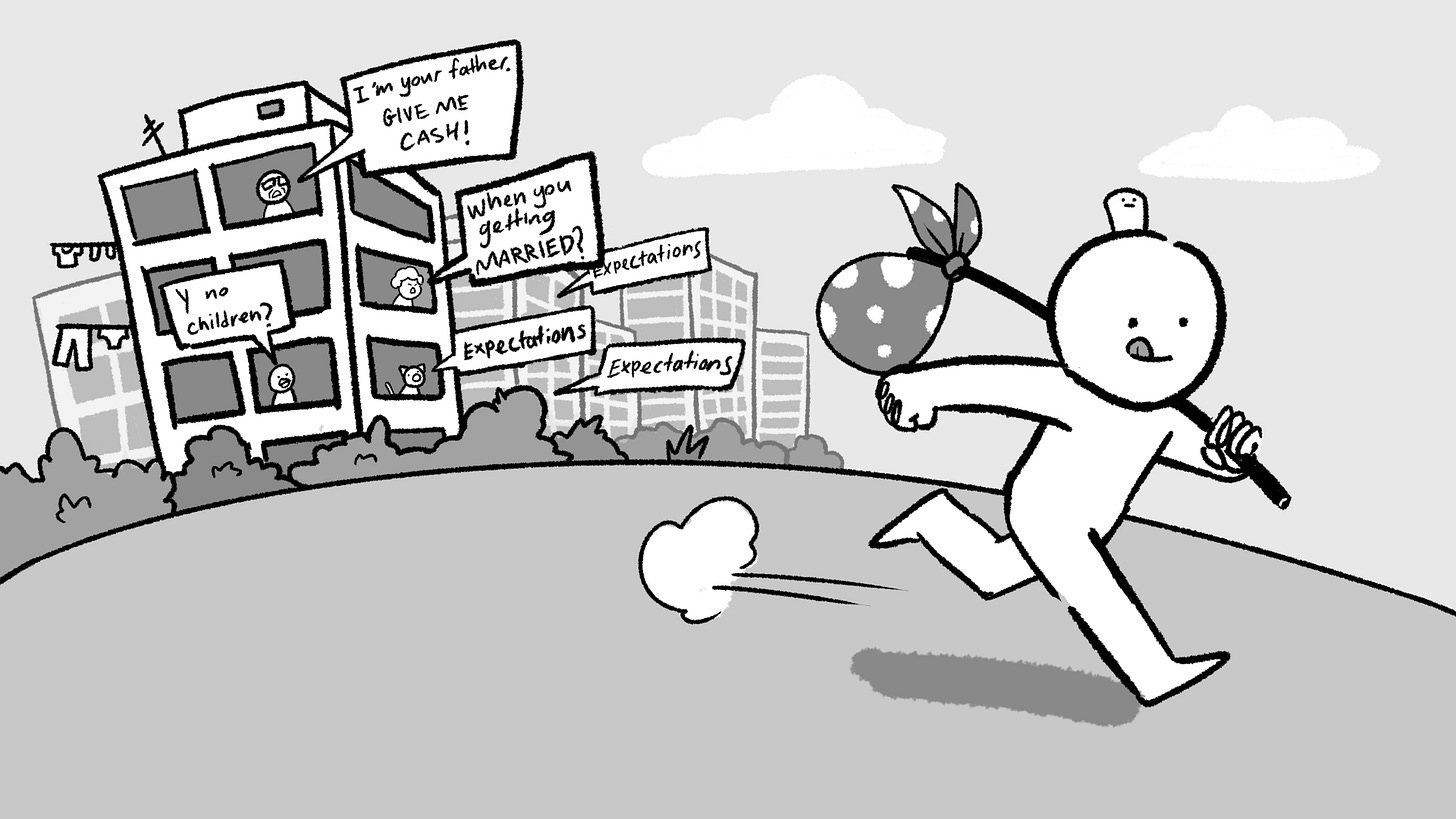

9. To escape outdated ideas of the previous generations, move the hell out.

2017 was the year I rented a room for $700 a month from a friend. While this cost me close to $9,000 that year, I could now make life decisions without the influence of my parents — who had some pretty outdated notions.

Some of them you might be familiar with:

“Give your parents 20% allowance to prove your filial piety.”

“You must have kids before 30.”

“Why haven't you bought a car yet?”

“We must invite 3,000 people to your wedding.”

“You must earn more than your wife.”

“If you don’t do XXX, what would our relatives think of us?”

My opinion is that some Singaporeans let their parents dictate their lives simply by living under their roof. Some of the decisions made by the older generation are outdated, expensive and perhaps the worst — irreversible.

But here’s the kicker: It is more costly to have an obsolete mindset than it is to pay rent.

Further reading:

10. Financial freedom is not a race with other people, it’s a marathon you run with yourself.

Since starting The Woke Salaryman, I’ve come across so many fascinating and inspiring people at different stages of their journey. At the same time, I’ve listened to enough cases of ruinous financial habits to write a book about it.

I’ve noticed a tendency for people to compare themselves to ‘financial influencers’, a group of people of which TWS is considered part of.

IMO, that’s really unhealthy because many times, bloggers and content creators don’t talk about the circumstances that helped them achieve their sky-high savings goals.

Either that, or they have talked about it, but people have forgotten.

Further reading:

So I’m going to go out on a limb and say this:

I managed to amass significant savings at a young age because I was fortunate enough to be born with several advantages:

I started out with no debt.

My parents adequately prepared for retirement (and even a stroke).

And I’m part of the majority race in Singapore.

If you're not any of these, chances are you’re going to have a harder time. But just because you only saved 30k by 30 doesn’t mean you’re any less capable than me — it just means you’ve had more to overcome.

But you know what? That shouldn’t prevent you from trying.

Think about it: there are spoiled rich kids out there with all the advantages, but are still totally reliant on their wealthy parents.

And there are people far less privileged than me who have done really, really, really well for themselves.

At the end of the day, it’s about mindset and taking a step in the right direction.

And it does not matter how slow you go, as long as you do not stop.

Stay woke, salaryman.

If you’ve read this far, please consider subscribing to our email newsletter (yes, this Substack). We cannot offer you much but we can offer this:

We have newsletter-exclusive articles that won’t be posted anywhere else. We created these articles for people who want to go deeper into complex issues than the shorter-form content we typically have.

If you don’t have social media or don’t follow our Telegram channel, you can still get updates to all our content emailed directly to your inbox to read at your own time.

We promise not to spam your inbox (but Substack might, so update your notification settings).

This was a great article that really got me thinking. Thanks for writing it. Have subscribed!